Estate Planning Attorney Fundamentals Explained

Wiki Article

Getting My Estate Planning Attorney To Work

Table of Contents10 Easy Facts About Estate Planning Attorney ShownAll About Estate Planning AttorneyFascination About Estate Planning AttorneyThe Best Guide To Estate Planning AttorneyThe 5-Second Trick For Estate Planning Attorney

An experienced attorney that understands all elements of estate preparation can help make sure customers' wishes are performed according to their purposes. With the best support from a dependable estate coordinator, people can feel confident that their strategy has been produced with due treatment and focus to detail. People require to spend appropriate time in locating the appropriate attorney who can provide sound suggestions throughout the whole process of establishing an estate strategy.The papers and instructions developed during the preparation process become lawfully binding upon the client's death. A certified economic advisor, according to the desires of the departed, will then begin to distribute depend on properties according to the customer's guidelines. It is essential to keep in mind that for an estate strategy to be reliable, it has to be properly executed after the client's death.

The appointed executor or trustee must guarantee that all possessions are dealt with according to legal requirements and in accordance with the deceased's wishes. This usually includes collecting all paperwork pertaining to accounts, investments, tax documents, and various other products specified by the estate plan. On top of that, the administrator or trustee might need to coordinate with financial institutions and recipients associated with the circulation of possessions and other issues referring to clearing up the estate.

In such situations, it may be needed for a court to interfere and solve any type of conflicts prior to final distributions are made from an estate. Inevitably, all elements of an estate should be resolved successfully and precisely in accordance with existing regulations to ensure that all parties included receive their fair share as planned by their loved one's dreams.

The Greatest Guide To Estate Planning Attorney

Individuals require to plainly comprehend all facets of their estate plan prior to it is established in motion (Estate Planning Attorney). Dealing with an experienced estate preparation attorney can assist make certain the files are effectively drafted, and all expectations are fulfilled. On top of that, a lawyer can provide insight right into just how various legal devices can be made use of to protect properties and maximize the transfer of wealth from one generation to one more

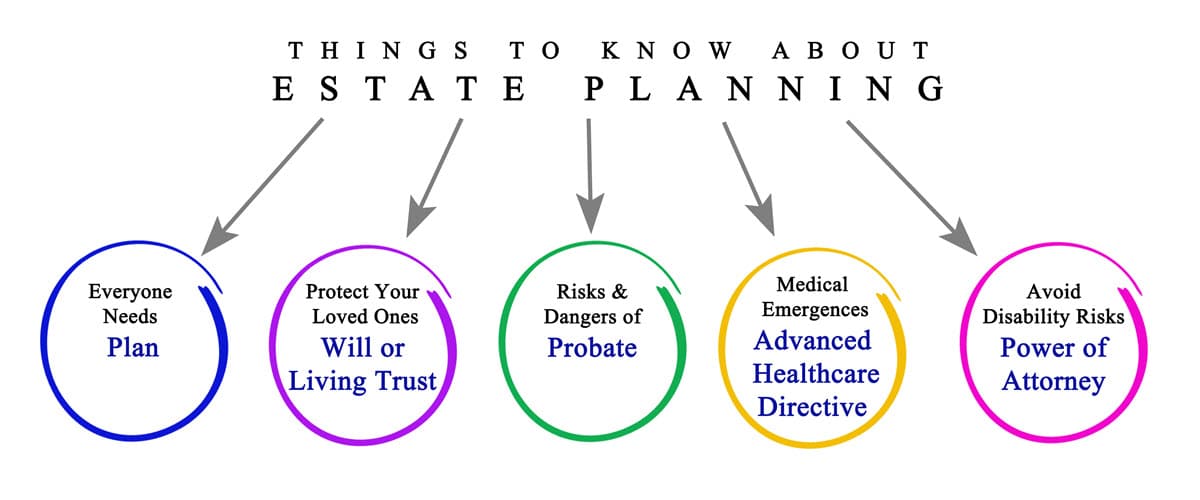

Estate planning refers to the prep work of jobs YOURURL.com that handle an individual's economic scenario in the occasion of their incapacitation or fatality - Estate Planning Attorney. This planning includes the legacy of possessions to heirs and the settlement of estate taxes and financial debts, along with various other factors to consider like the guardianship of minor children and pet dogs

A few of the steps include listing properties and financial obligations, evaluating accounts, and creating a will certainly. Estate planning jobs include making a will, establishing trust funds, making charitable donations to restrict inheritance tax, calling an executor and recipients, and establishing funeral plans. A will certainly gives guidelines regarding residential or commercial property and guardianship of small children.

The Ultimate Guide To Estate Planning Attorney

Estate planning can and should be utilized by everyonenot simply the ultra-wealthy. Estate planning includes establishing how a person's properties will be preserved, managed, and dispersed after fatality. It also considers the monitoring of an individual's residential properties and monetary commitments in the event that they end up being incapacitated. Possessions that can make up an estate include homes, automobiles, supplies, art, collectibles, life insurance policy (Estate Planning Attorney), pension plans, financial debt, and extra.

Anybody canand shouldconsider estate planning. There are different reasons that you could begin estate planning, such as preserving family wealth, offering a making it through spouse and kids, funding youngsters's or grandchildren's education, and leaving your legacy for a philanthropic reason. Creating a will is just one of one of the most vital actions.

Evaluation your retirement accounts. This is essential, particularly for accounts that have beneficiaries affixed to them. Remember, any accounts with a recipient pass straight to them. 5. Evaluation your insurance coverage and annuities. Make sure your beneficiary information is up-to-date and all of your various other info is precise. 6. Set up joint accounts or transfer of fatality classifications.

Facts About Estate Planning Attorney Uncovered

8. Create your will. Wills do not simply decipher any type of economic uncertainty, they can check over here additionally lay out plans for your small youngsters and pets, and you can likewise advise your estate to make philanthropic donations with the funds you leave behind. 9. Evaluation your documents. Ensure you look into every little thing every couple of years and make modifications whenever you choose.

Send a copy of your will certainly to your manager. This ensures there is no second-guessing that a will exists or that it gets lost. Send one to the person who will think responsibility for your events after you pass away and maintain an additional duplicate someplace secure. 11. See an economic specialist.

More About Estate Planning Attorney

There are tax-advantaged investment vehicles you can capitalize on to aid you and others, such as 529 college savings prepares for your grandchildren. A will is a legal file that provides directions about just how an individual's home and safekeeping of small kids (if any) ought to be managed after Recommended Reading death.

Report this wiki page